Our NEW isolved release goes live

December 1, 2023

Release 9.23 has some exciting new additions! We are working hard to provide the best tools for you and your team.

In this release:

- Auto Job Matching

- Employee Paystub by Date Range Report

- Alabama Overtime

- FUTA Credit Reduction Placeholder 2023

- Screen Updates

Platform

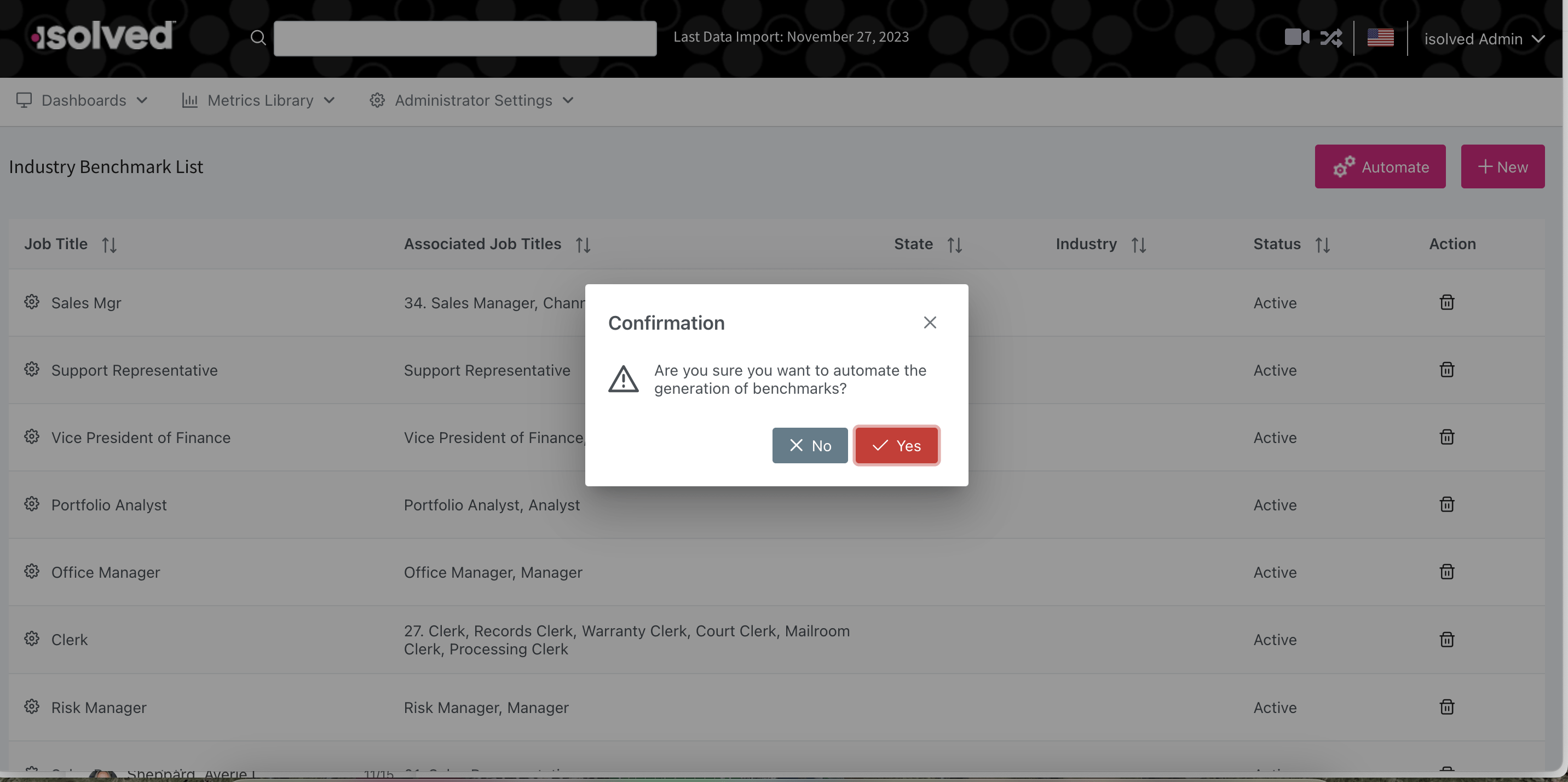

Auto Job Matching

For those who have Benchmark Insights in Predictive People Analytics (PPA), job matching is about to become a breeze! This functionality will be rolled out in two phases and aims to streamline the process of matching jobs against those in the benchmark library using AI technology. The first phase of job benchmarking automation is rolling out this release. The system will be able to run a benchmark job import in the background and match your job titles to an exact title and/or any title closest to it.

Below is the breakdown of the two-phased approach:

Phase 1 (release v9.23 on 12/01/23) – This automation will allow for the matching of all the clients positions to top level job titles with a single click.

Phase 2 (Q1 2024) – This follow-on automation will also allow matching the title by state and industry plus allowing clients to edit each individual matched entry.

Payroll

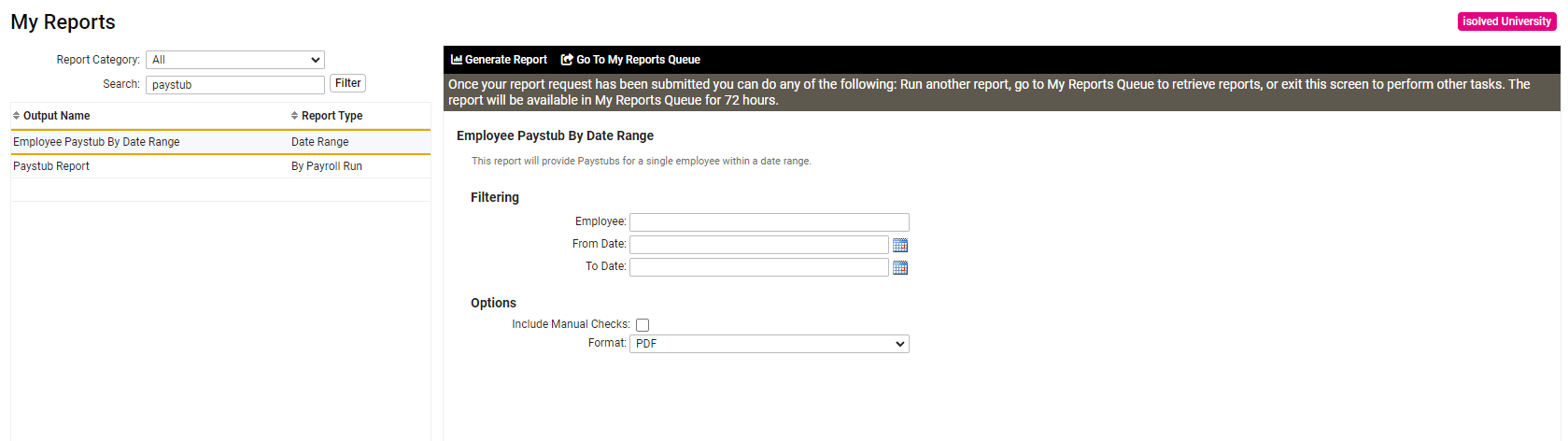

Employee Paystub by Date Range Report

We know this is going to be exciting for many! With this release, we’ve added the Employee Paystub by Date Range report!

This report will allow an employee to be selected along with a date range within one year, and all the paystubs issued to them in that timespan will be reported into a document. Plus, there will be an option to include manual checks!

The following checks are not included:

- 3rd Party Sick

- Adjustment

- Void Check

- Wage Adjustment

Alabama Overtime

Effective January 1, 2024, a new Alabama law, Act 2023-421, excludes wages received by hourly employees for hours worked above 40 hours in any given week from gross income. This will apply to both Alabama residents and non-residents, and the state is requiring that the overtime earnings are shown separately on the W-2s. Please contact Support for assistance with getting this new earning set up if you have employees who are subject to this exemption.

Please note: The overtime Alabama earnings will be exempt only from state withholding tax and will still be subject to SUI and federal taxes.

FUTA Rate 2023

You may notice something extra on pay stubs and we have a reason for that! Five states faced a potential FUTA credit reduction in 2023. Three of those states/regions, California, New York, and the US Virgin Islands still had remaining outstanding advances before the November 10, 2023 deadline, and employers in these three states will face a credit reduction according to the chart below:

| State | FUTA Credit? | Rate | Effective Date |

| CA | Yes | .6% | 12-1-23 |

| NY | Yes | .6% | 12-1-23 |

| VI | Yes | 3.9% | 12-1-23 |

The calculation for California, New York, and the US Virgin Islands FUTA Credit reductions will start with check date 12-1-23 and after.

Screen Updates

Over the next few months, you will see that we are refreshing several screens, moving them to a more modern look using the new grid style that you have already seen on other newer screens. The overall functionality stays the same with some differences noted below.

This is an example of the new screen, where you can sort, filter, group, and view all pieces of information:

The following Screens have been updated in this release.

Client Management > HR Management > Training and Development > Training:

- Updated grid layout.

- Added export all data to Excel.

- Added filtering to all columns.

- Added edit button.

Client Management > Tables > Employment Statuses:

- Updated grid layout.

- Added export all data to Excel.

- Added filtering to all columns.

- Added edit button.

Payroll Processing > Payroll Entry Setup > Time Entry Templates:

- Updated grid layout.

- Added export all data to Excel.

- Client Time Entry Template, Earnings & Memo Calcs, Deductions and Tax Categories all available through added edit button.