Apply for Paycheck Protection Program (PPP) loan forgiveness

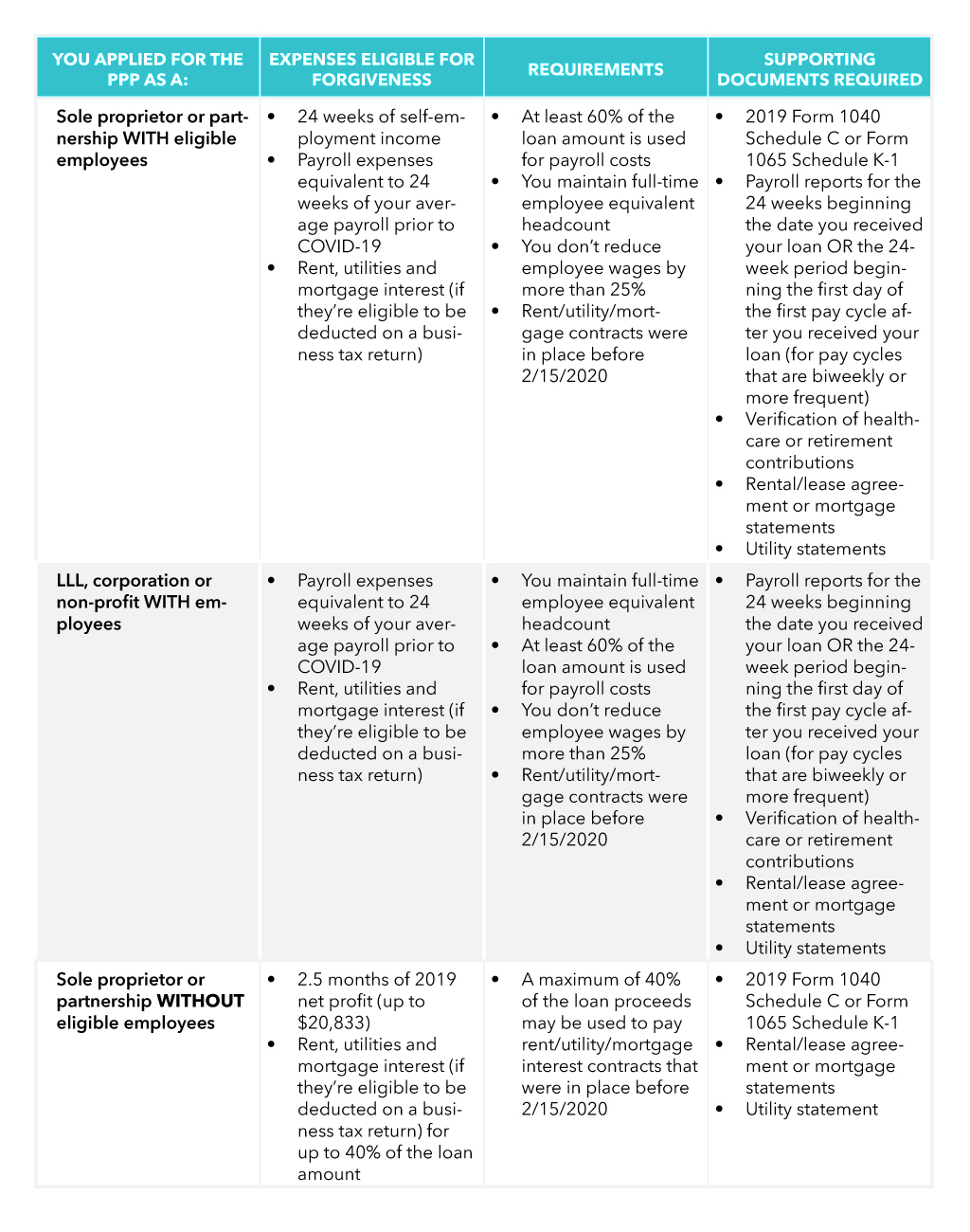

Get up to 100% of your PPP loan forgiven based on your employee status, payroll, and how you used the loan funds.

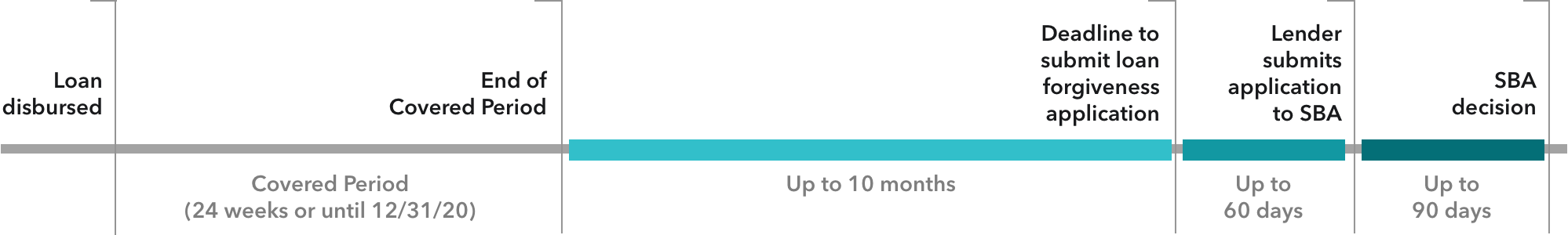

Based on current information, we recommend waiting until guidelines are finalized, and until the end of your 24-week Covered Period to apply for loan forgiveness. This will give you more time to accrue and track eligible expenses, which could help increase your loan forgiveness amount.