Our NEW isolved release goes live

January 26, 2024

Release v10.1 is set to be a maintenance release that mainly includes standard background updates and fixes. We are always working hard to provide the best tools for you and your team.

In this release:

- South Carolina and West Virginia SOC

- Tax Form Updates

- January Tax Updates

HR & Payroll

South Carolina and West Virginia SOC

With the Q1 2024 Unemployment filing for South Carolina and West Virginia, the SOC will be required for all employees who work in either state.

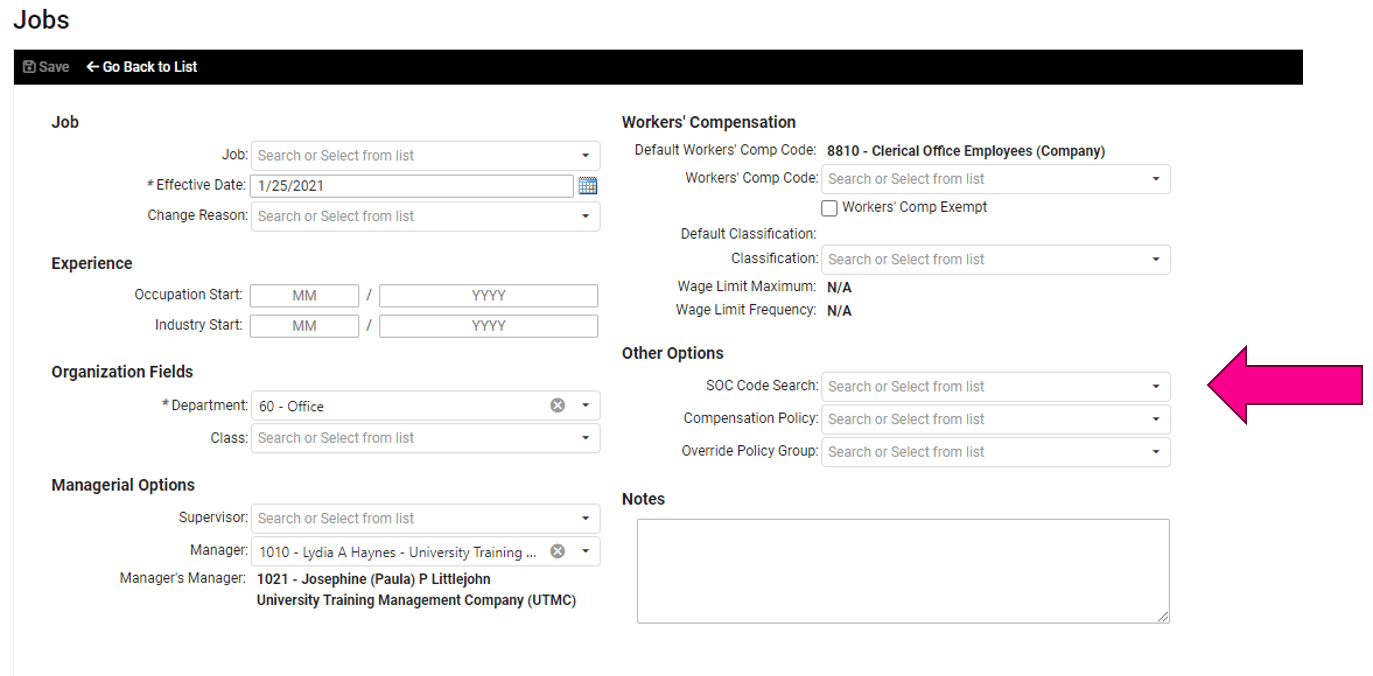

Starting this release, we are encouraging partners and clients to start completing this information on the Employee Management > Employee Maintenance> Jobs screen as soon as possible to ensure all employees in these two states are updated before the Q1 2024 filing date. The isolved system will be updated to require these fields with the 10.3 release on 2/23/2024.

Tax Form Updates

With this release, we’ve made updates to Federal withholding forms, State withholding forms, employee withholding forms that are used in onboarding, and those using the Tax Updates functionality in self-service.

| U.S. Form Changes | Functionality Corrections and Updates |

| Federal: Form W-4(SP)

California: Form DE-4 Georgia: Form G-4 Idaho: Form ID-MS1 Iowa: Form IA 44-016, Form IA W-4(SP) New York: Form IT-2104, Form IT-2104-E, Form IT2104-SNY |

Michigan: Corrected predominant place of employment error

New York: Updated survey questions for NY PFML opt out

Miscellaneous: Corrected issue with perjury statement box |

Please refer to the full Symmetry Release document for more details.

January Tax Updates

With this release, tax updates have been applied for several state and local taxes. You can view the full list of updates at this link: Summary of Modifications