Our NEW isolved release goes live

December 30, 2022

Release 8.25 – is jam-packed with exciting new additions!

We are working hard to provide the best tools for you and your team.

In this release:

- Workforce Management: Time Card Objections

- Tax: Paid Family Leave and Arizona Withholding

Workforce Management

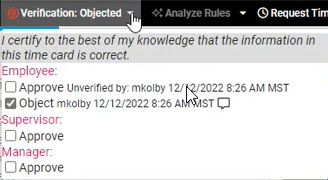

Time Card Objections Added to Verification Rules

In our 8.25 release, those who use isolved Time & Attendance can implement Timecard Objection for Employees. Employees will have an opportunity to object to their timecard and must enter comments as to why the information is not accurate.

Managers/Supervisors can be notified by Email/AEE to address concerns the employee may have, if employees object to the timecard contents. Managers/Supervisors can update the timecard based on the details of the objection. Once the timecard is modified, the employee will have an opportunity to Verify or Object the timecard again. Managers/Supervisors can Approve an objected timecard and will not affect the objection.

Client Users can add a verification alert of Critical/Warn Me/Ignore to the objection. Both the Verification Export and Verification Audit Export have been updated to include the new Timecard Objection Status.

Tax

Paid Family Leave – Colorado and Oregon

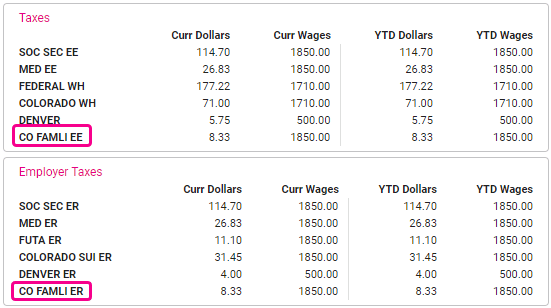

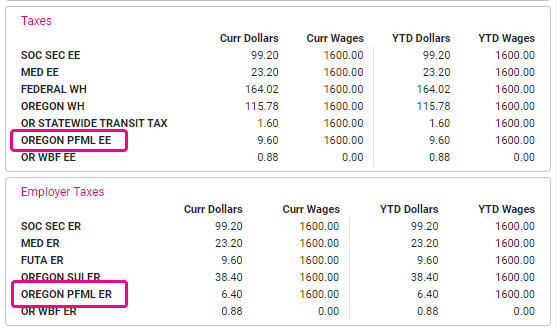

We’ve gotten some questions asking if isolved People Cloud is ready for the new paid family leave for Colorado and Oregon, and the answer is YES! The new taxes are loaded and ready for employees in the applicable tax locations as of the January 1st effective date.

Effective 1/1/2023, Colorado Family and Medical Leave Insurance will appear on pay stubs and reports as a tax labeled as shown:

Effective 1/1/2023, Oregon Paid Family and Medical Leave will appear on check previews, pay stubs and reports as a tax labeled as shown:

Arizona Withholding

A tax update was added on 12/22/2022 to add the new Arizona withholding percentages to the Tax Information screen. Employees should fill out their new Form A-4 for 2023. The 2023 form will be available on the Tax Updates screen on 1/1/2023. The release in late January will remove the previous rate options and any existing employees who have not updated Form A-4 will have their taxes calculated at the default rate of 2% until updated.